Gold Rebounds Off Support on Rising Tensions in Ukraine- $1292 Key

Here you can find all the latest breaking forex and currency news about Gold Rebounds Off Support on Rising Tensions in Ukraine- $1292 Key including currency analysis and forecasts, live foreign exchange rates, central bank interest rates, and currency trading strategies from experienced fx traders and forex platforms.

Fundamental Forecast for Gold:Neutral

- Gold Maintains Constructive Look on Swing Basis

- Gold Searches For Direction Ahead of US Data, Crude Oil Plummets

- Sign up for DailyFX on Demand For Real-Time Gold Updates/Analysis Throughout the Week

Gold prices are softer at the close of trade this week with the precious metal off by 0.40% to trade at $1304 ahead of the New York close on Friday. Bullion had held a tight range below key resistance at $1321 for the majority of the week before tumbling to key support at $1292 on Friday. The losses were short lived however with headlines over the escalating situation in Ukraine prompting a reversal that saw prices pare more than half the day’s decline. With geopolitical tensions on the rise, gold could remain supported with key US data next week and the Jackson Hole Economic Symposium likely to drive prices.

Weaker than expected US retail sales, empire manufacturing and consumer confidence this week has continued to cap USD advances near-term with the Dow Jones FXCM Dollar Index struggling to close the week above key resistance at 10,564. The August Preliminary University of Michigan Consumer Confidence survey released on Friday fell short of market expectations with a print of 79.2, missing calls for a read of 82.5 and weaker than last month’s print of 81.8. The data marks the lowest read on the survey since November of last year and follows a string of weaker-than-anticipated metrics for the US.

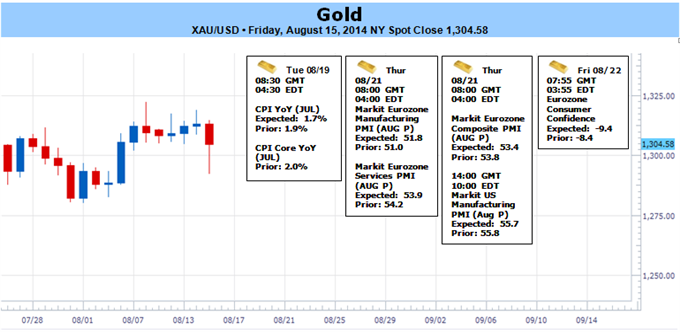

Looking ahead to next week traders will be closely eyeing the return of more pertinent US economic data with CPI, housing metrics and the release of the FOMC minutes from the July 30th meeting on tap. Inflation data on Tuesday is expected to show a slight softening in the annualized rate with consensus estimates calling for a down tick to 2% y/y with core inflation widely expected to hold at 1.9% y/y. Minutes from the latest FOMC policy meeting are released on Wednesday and investors will be closely eying the transcript for clues as to the committees outlook on interest rates and the economy. Look for gold to trade heavy if the minutes show a greater willingness amongst policy makers to begin normalizing sooner rather than later with headlines out of Jackson Hole next week also likely to spur added volatility in gold and USD crosses.

From a technical standpoint, gold remains within the confines of a well-defined descending channel formation off last month’s high. Friday’s sell-off took gold into key support at $1292 before rebounding sharply mid-day in New York after reports that Ukrainian forces had destroyed an armed Russian convoy that was crossing the border into Ukraine. This level is defined by confluence of the 50% retracement from the advance off the June lows and the 61.8% extension from the decline off the July high. The sheer magnitude of the rebound took gold back into the initial weekly opening range and as such we’ll maintain a neutral bias heading into next week’s event risk while noting that our bearish invalidation level remains unchanged at $1321. A break sub-$1292 is needed to re-assert our bearish outlook with such a scenario eyeing key support at $1260/68. A breach of the highs targets channel resistance dating back to the yearly high with subsequent resistance objectives seen at $1334 and the July high at $1345.

---Written by Michael Boutros, Currency Strategist with DailyFX

To contact Michael email [email protected] or follow him on Twitter @MBForex

To be added to Michael’s distribution list Click Here

New to FX Trading? Watch this Video

original source

The article above is about breaking forex and currency news regarding Gold Rebounds Off Support on Rising Tensions in Ukraine- $1292 Key, if you have any question about it. Please contact us by using the link below. Thanks for your patience.

- Japanese Yen Gains, Nikkei Falls as BOJ Leaves Policy Unchanged

- Chinese Business Sentiment Contracts for the First Time in 4 Months

- Dismal UK Retail Sales to Spur Another Test of GBP/USD Resilience

- Forex-Webinar:-FOMC-Minutes-Reinforce-Hike-Forecast

- Trading Video: Dollar Fails to Rally on Hawkish FOMC, Equities Rally

- Among Top Themes, Where is the Risk Most Potent: Fed Hike, China, EM?

- EUR/USD Technical Analysis: Looking to Short on Bounce

- US Dollar Declines as FOMC Minutes Bring Nothing New to the Table

- US DOLLAR Technical Analysis: USD Holds Support on FOMC Minutes

- WTI Crude Oil Price Forecast: What Now That $40bbl Broke?

- Fingertrp Scalping with James Stanley (Using Tradingview Charts)

- EUR/USD Risks Fresh Monthly Lows on Hawkish FOMC Minutes

- Analyst Pick - Kiwi & CAD in Focus

- Price & Time: USD/CAD ? It?s Showtime

- GBP/USD Ranges Ahead of FOMC Minutes

- President Xi Warns That China Faces Considerable Downward Pressure

- FOMC Minutes Later Today - USD Set for October 28 Redux

- Silver Price Is Targeting Its Yearly Low

- FTSE 100: Commodity Markets Wants to See The FTSE 100 at 6040

- DAX 30: Momentum Slows Down, FOMC Minutes on Tap

- US Dollar May Extend Gains as Fed Minutes Foreshadow Rate Hike

- Copper Surplus Faces Falling Premiums; Gold Slides before Fed Minutes

- China Real Estate Market Recovery Slows in October

- Traders Not as Confident of Fed Hike as Markets, Economists

- EUR/GBP Technical Analysis: Euro Drops to 3-Month Low

- Dollar Unmoved After China Treasury Holdings Hit a 7 Month Low

- Can Dollar Climb Continue After FOMC Forecast Shift?

- Dollar’s CPI Rally Lacking, Stall in Risk Raises Yen Crosses Appeal

- NZD/USD Technical Analysis: Short Trade Activated Sub-0.65

- Will the DAX Crack or Cower from Resistance?