Need to See a Larger Move to Confirm S&P 500 Top

Here you can find all the latest breaking forex and currency news about Need to See a Larger Move to Confirm S&P 500 Top including currency analysis and forecasts, live foreign exchange rates, central bank interest rates, and currency trading strategies from experienced fx traders and forex platforms.

Receive the Weekly Speculative Sentiment Index report via PDF via David’s e-mail distribution list.

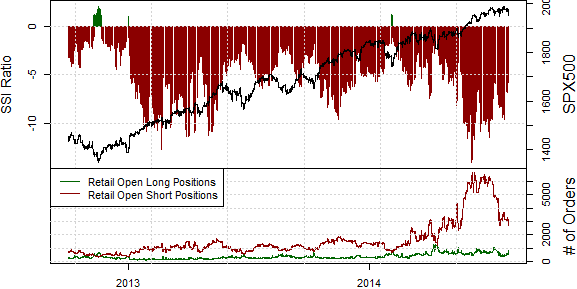

SPX500 – Retail CFD speculators remain heavily short the SPX500 contract, which tracks the fair value of the S&P 500 futures price. Until we see a larger shift in sentiment we’ll continue to call for further gains.

Trade Implications SPX500 – Last week we noted that equity markets seemed almost “Unbreakable”. We’ve since seen a non-negligible shift in sentiment as the trading crowd grows less short; total long positions have doubled while short positions are down 30 percent. Yet there remain nearly 3 orders short for every long, and we’ll need to see a much more substantial move in sentiment to have any confidence in calling for a larger breakdown. Month-to-date lows of $1950 remain of particular interest.

See next currency section: NZDUSD - New Zealand Dollar at Clear Risk of Further Losses

--- Written by David Rodriguez, Quantitative Strategist for DailyFX.com

Automate our SSI-based trading strategies via Mirror Trader free of charge

To receive the Speculative Sentiment Index and other reports from this author via e-mail, sign up for his distribution list via this link.

Contact David via

Twitter at http://www.twitter.com/DRodriguezFX

Facebook at http://www.Facebook.com/DRodriguezFX

original source

The article above is about breaking forex and currency news regarding Need to See a Larger Move to Confirm S&P 500 Top, if you have any question about it. Please contact us by using the link below. Thanks for your patience.

- Japanese Yen Gains, Nikkei Falls as BOJ Leaves Policy Unchanged

- Chinese Business Sentiment Contracts for the First Time in 4 Months

- Dismal UK Retail Sales to Spur Another Test of GBP/USD Resilience

- Forex-Webinar:-FOMC-Minutes-Reinforce-Hike-Forecast

- Trading Video: Dollar Fails to Rally on Hawkish FOMC, Equities Rally

- Among Top Themes, Where is the Risk Most Potent: Fed Hike, China, EM?

- EUR/USD Technical Analysis: Looking to Short on Bounce

- US Dollar Declines as FOMC Minutes Bring Nothing New to the Table

- US DOLLAR Technical Analysis: USD Holds Support on FOMC Minutes

- WTI Crude Oil Price Forecast: What Now That $40bbl Broke?

- Fingertrp Scalping with James Stanley (Using Tradingview Charts)

- EUR/USD Risks Fresh Monthly Lows on Hawkish FOMC Minutes

- Analyst Pick - Kiwi & CAD in Focus

- Price & Time: USD/CAD ? It?s Showtime

- GBP/USD Ranges Ahead of FOMC Minutes

- President Xi Warns That China Faces Considerable Downward Pressure

- FOMC Minutes Later Today - USD Set for October 28 Redux

- Silver Price Is Targeting Its Yearly Low

- FTSE 100: Commodity Markets Wants to See The FTSE 100 at 6040

- DAX 30: Momentum Slows Down, FOMC Minutes on Tap

- US Dollar May Extend Gains as Fed Minutes Foreshadow Rate Hike

- Copper Surplus Faces Falling Premiums; Gold Slides before Fed Minutes

- China Real Estate Market Recovery Slows in October

- Traders Not as Confident of Fed Hike as Markets, Economists

- EUR/GBP Technical Analysis: Euro Drops to 3-Month Low

- Dollar Unmoved After China Treasury Holdings Hit a 7 Month Low

- Can Dollar Climb Continue After FOMC Forecast Shift?

- Dollar’s CPI Rally Lacking, Stall in Risk Raises Yen Crosses Appeal

- NZD/USD Technical Analysis: Short Trade Activated Sub-0.65

- Will the DAX Crack or Cower from Resistance?