ECB Sets Table for Lower Euro Prices ? Here’s How

Here you can find all the latest breaking forex and currency news about ECB Sets Table for Lower Euro Prices ? Here’s How including currency analysis and forecasts, live foreign exchange rates, central bank interest rates, and currency trading strategies from experienced fx traders and forex platforms.

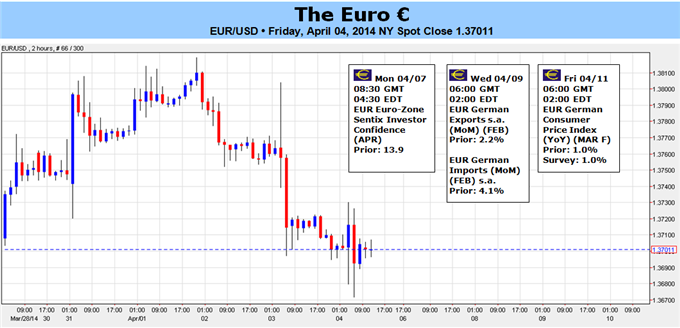

Fundamental Forecast for Euro: Bearish

- The Euro saw its highs early in the week but was generally weaker into the ECB rate decision.

- The ECB rate decision carried a heavy dovish connotation, leading to bearish opportunities in several EUR-crosses.

- Have a bullish (or bearish) bias on the Euro, but don’t know which pair to use? Use a Euro currency basket.

The European Central Bank’s (ECB) patience with the region’s lackluster recovery may be running out, if one is to believe the rhetoric deployed by President Mario Draghi at the April press conference. Although the ECB held its main refinancing rate on hold at 0.25%, a record low, it was clear that the downturn in economic data over the past several weeks, highlighted by the headline March CPI figure coming in at +0.5% y/y, a four-plus year low, and far beneath the ECB’s medium target of +2%.

There were several tweaks in ECB President Mario Draghi’s tone on Thursday that suggested a more dovish consensus is forming among the Governing Council Members. It was made clear that the council voted unanimously to explore the use of unconventional monetary policy measures, even as President Draghi noted that all the conventional tools hadn’t yet been deployed. Negative interest rates and a round of the ECB’s own version of quantitative easing (QE) was discussed.

The implication that the ECB stands ready to act in the face of a deflating price environment and soft economic horizon inherently suggests an air of credibility to the idea that the ECB could implement non-standard accommodative policy measures. In meetings past, any such commentary that implied the desire for a weaker Euro or hope for continued improvement in growth was met with skepticism by the market; the Euro had developed the reputation for bouncing back after the past several meetings, including the November rate cut (an important low for EURUSD formed that day).

Now that it’s been made clear by the ECB that it recognizes jawboning is losing gravitas – threats of action but no such specific action (see: the ECB’s success with bringing down PIIGS sovereign bond yields without having to operate within the scope of the OMT, not even once) – the path forward will require more explicit details of what measures the ECB might take going forward.

In recent weeks, several policymakers have expressed their displeasure with the elevated Euro exchange rate, and it’s of little surprise that a threat of implementing negative deposit rates would be utilized in order to stem speculative inflows into the currency. The other threat, a full blown QE program, saw its first trial balloon float by on Friday, when German media outlet FAZ reported that the ECB had modeled a €1 trillion QE program, with results seeing anywhere from a +0.2% to +0.8% increase in inflation.

For now the table is set for the Euro to fall but several things will need to develop in the coming weeks and months in order for weakness to flourish – and that’s because there is a trade cushion supporting a higher Euro exchange rate. First, as noted by President Draghi, the stress tests (AQR: asset quality review) have resulted in curbed risk taking by Euro-Zone banks; and to avoid creating a panic about the system before the tests in November, the ECB will try to avoid another liquidity injection.

Accordingly, the economic data picture must remain soft for the ECB’s dovish threats to carry any weight insofar as the threat of non-standard policy measures doesn’t seem legitimate in the face of improving growth prospects and elevated price pressures. Neither of those conditions exist presently (Citi Economic Surprise Index hit a fresh yearly low at -9.0 on Thursday, and was at -8.3 at Friday’s close; both headline CPI and PPI readings are at their lowest levels in over four years). With several EUR-crosses showing technical patterns that would indicate lower Euro prices, continued weakness in economic data will be the only fuel needed to weigh down the once-resilient currency. –CV

To receive reports from this analyst, sign up for Christopher’s distribution list.

original source

The article above is about breaking forex and currency news regarding ECB Sets Table for Lower Euro Prices ? Here’s How, if you have any question about it. Please contact us by using the link below. Thanks for your patience.

- Japanese Yen Gains, Nikkei Falls as BOJ Leaves Policy Unchanged

- Chinese Business Sentiment Contracts for the First Time in 4 Months

- Dismal UK Retail Sales to Spur Another Test of GBP/USD Resilience

- Forex-Webinar:-FOMC-Minutes-Reinforce-Hike-Forecast

- Trading Video: Dollar Fails to Rally on Hawkish FOMC, Equities Rally

- Among Top Themes, Where is the Risk Most Potent: Fed Hike, China, EM?

- EUR/USD Technical Analysis: Looking to Short on Bounce

- US Dollar Declines as FOMC Minutes Bring Nothing New to the Table

- US DOLLAR Technical Analysis: USD Holds Support on FOMC Minutes

- WTI Crude Oil Price Forecast: What Now That $40bbl Broke?

- Fingertrp Scalping with James Stanley (Using Tradingview Charts)

- EUR/USD Risks Fresh Monthly Lows on Hawkish FOMC Minutes

- Analyst Pick - Kiwi & CAD in Focus

- Price & Time: USD/CAD ? It?s Showtime

- GBP/USD Ranges Ahead of FOMC Minutes

- President Xi Warns That China Faces Considerable Downward Pressure

- FOMC Minutes Later Today - USD Set for October 28 Redux

- Silver Price Is Targeting Its Yearly Low

- FTSE 100: Commodity Markets Wants to See The FTSE 100 at 6040

- DAX 30: Momentum Slows Down, FOMC Minutes on Tap

- US Dollar May Extend Gains as Fed Minutes Foreshadow Rate Hike

- Copper Surplus Faces Falling Premiums; Gold Slides before Fed Minutes

- China Real Estate Market Recovery Slows in October

- Traders Not as Confident of Fed Hike as Markets, Economists

- EUR/GBP Technical Analysis: Euro Drops to 3-Month Low

- Dollar Unmoved After China Treasury Holdings Hit a 7 Month Low

- Can Dollar Climb Continue After FOMC Forecast Shift?

- Dollar’s CPI Rally Lacking, Stall in Risk Raises Yen Crosses Appeal

- NZD/USD Technical Analysis: Short Trade Activated Sub-0.65

- Will the DAX Crack or Cower from Resistance?